When To File ISF For TV Mounts & Carts

What happens when you import a TV mount or cart? Do you consider all the different regulations and requirements that come with it? One that might often get overlooked is the Importer Security Filing (ISF). Understanding when and how to file an ISF for these items is crucial for ensuring that your shipping process runs smoothly.

Understanding ISF (Importer Security Filing)

ISF, also known as 10+2, is a requirement by U.S. Customs and Border Protection (CBP) for importers. This regulation mandates you to provide specific data about your shipment before it arrives in the United States. The objective is to facilitate risk assessment and enhance imports security.

Why ISF Matters

Filing an ISF isn’t merely a bureaucratic hurdle; it serves a critical purpose in international trade. It helps CBP identify potential risks associated with your cargo and ensures safer entry into the U.S. for the goods. Failing to file properly can lead to heavy fines and delays, which can affect your entire supply chain.

What Items Require an ISF?

Many goods necessitate an ISF when imported, especially those categorized as high-risk products. So, when it comes to TV mounts and carts, you must know that these items are indeed subject to this requirement. This section will clarify what qualifies as a TV mount or cart.

Categories of TV Mounts & Carts

The term “TV mounts and carts” can cover quite a broad spectrum. This classification affects how you file your ISF.

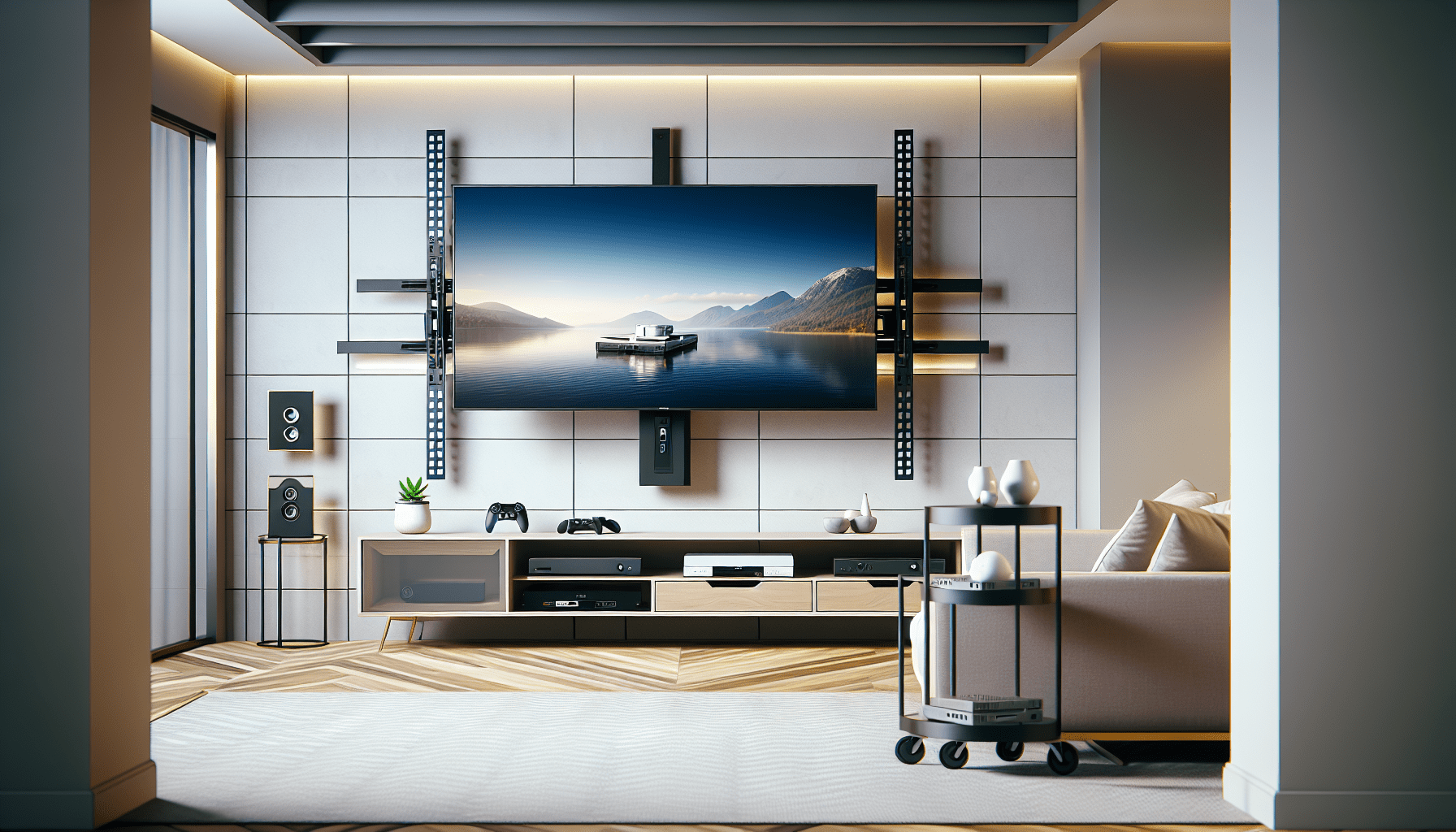

Wall Mounts

Wall mounts typically secure a TV directly to a wall, saving space and providing a clean aesthetic. Being structured from materials like metal or plastic, most wall mounts fall under the same import regulations.

Mobile Carts

These are movable structures that hold TVs and can be wheeled from one location to another. Often used in presentations or events, they may be subject to different regulations based on their design and functionality.

Specialty Mounts

Some mounts cater to specific needs, such as articulating arm mounts or heavy-duty mounts for larger televisions. These specialty mounts may have different import regulations due to their unique features.

Timing Your ISF Filing

Now that you have a grasp of what qualifies as TV mounts and carts, the next step is determining when to file your ISF. Timing is everything in the world of imports.

Filing Deadline

You’re required to submit your ISF at least 24 hours before the cargo is loaded onto the vessel. This timeline allows CBP to perform their necessary risk assessments and organize security measures.

Critical Moments to Consider

Customs Broker Notification: If you’re employing a customs broker, ensuring they are notified about your shipment in advance is paramount. They’ll help manage the ISF filing process easily.

Changes in Shipping Plans: If there are modifications to the original shipping plan—like a change in the destination or route—it’s crucial to refile your ISF accordingly.

Required Information for ISF Filing

So, what do you need to include in your ISF filing? There are specific data points that need to be provided to CBP.

Essential Data Elements

Your ISF should contain 10 specific data elements. Here is a detailed list:

| Data Element | Explanation |

|---|---|

| 1. Importer’s Name | The name of the individual or company importing the goods. |

| 2. Importer’s Address | The physical address where the importer is established. |

| 3. Consignee Name | Name of the final recipient of the goods. |

| 4. Consignee Address | Address of the final recipient. |

| 5. Manufacturer Name | Manufacturer of the goods imported. |

| 6. Manufacturer Address | Manufacturer’s physical address. |

| 7. Country of Origin | The country where the goods were manufactured. |

| 8. Harmonized Tariff Number | Used to classify goods for international shipping. |

| 9. Item Description | A detailed description of the item(s). |

| 10. Bill of Lading Number | Unique identifier for your shipment. |

Importance of Accuracy

Accurate and complete information is vital. Omissions or errors can lead to severe penalties and shipment delays. Always double-check the entered data before submission.

Consequences of Late or Incorrect Filings

Filing your ISF timely and accurately can spare you from many headaches. Let’s break down the possible consequences if something goes wrong.

Fines for Non-Compliance

Late Filing Penalties: If you fail to file the ISF on time, the CBP may impose fines, often amounting to $5,000 per violation.

Incorrect Information: Providing inaccurate details may not only induce fines but can also result in cargo holds at ports.

Retrieval Delays

If your ISF is filed late or inaccurately, you might encounter significant delays in retrieving your cargo. This can disrupt workflows, particularly if you rely on those TV mounts and carts for a timely installation or setup.

Tips for Efficient ISF Filing

To make the process smoother and more efficient, consider implementing these best practices.

Work with Customs Brokers

Having an efficient customs broker can make all the difference. Brokers often have a wealth of experience in filing ISFs. They can guide you through nuances in the documentation that may save you time and hassle.

Use Automated Systems

Leveraging technology can streamline the filing process. Many companies employ software solutions that assist in preparing the necessary documentation electronically. This minimizes manual errors and ensures all data is properly formatted.

Keep Records

Maintain a record of all ISF submissions. Documentation is key in case of queries from CBP. Keeping meticulous records will also serve as a valuable resource for future imports.

Conclusion

Understanding when and how to file your ISF for TV mounts and carts is not just another checkpoint in your import journey. It’s an essential factor for ensuring seamless logistics and adherence to U.S. laws.

By grasping the nuances of required data elements, the importance of timing, and adhering strictly to compliance standards, you can avoid unnecessary fines and delays. Your shipment deserves precision and care, and by taking these steps, you will set the stage for a worry-free import experience.

In the dynamic world of international trade, knowledge is your most effective asset. Whether you’re importing a handful of TV mounts for a project or a bulk order for your business, mastering the ISF process will pave the way for smoother operations. Stay informed, stay compliant, and watch your import operations flourish.