Unlock Secrets to Evade ISF Penalties for Rubber Products

Have you ever wondered what it takes to navigate the complexities of importing rubber calenders without incurring unnecessary penalties? Understanding the intricacies of Importer Security Filing (ISF) can save you considerable headaches and financial loss down the line. It’s crucial to grasp the essentials to ensure your imports are compliant and avoid penalties.

Understanding ISF and Its Importance

To effectively avoid ISF penalties for rubber calenders, you first need to grasp what ISF entails. Importer Security Filing is a U.S. Customs and Border Protection (CBP) requirement that mandates importers to submit specific information about their shipments before they arrive at U.S. ports. This is designed to enhance security and facilitate the processing of imports.

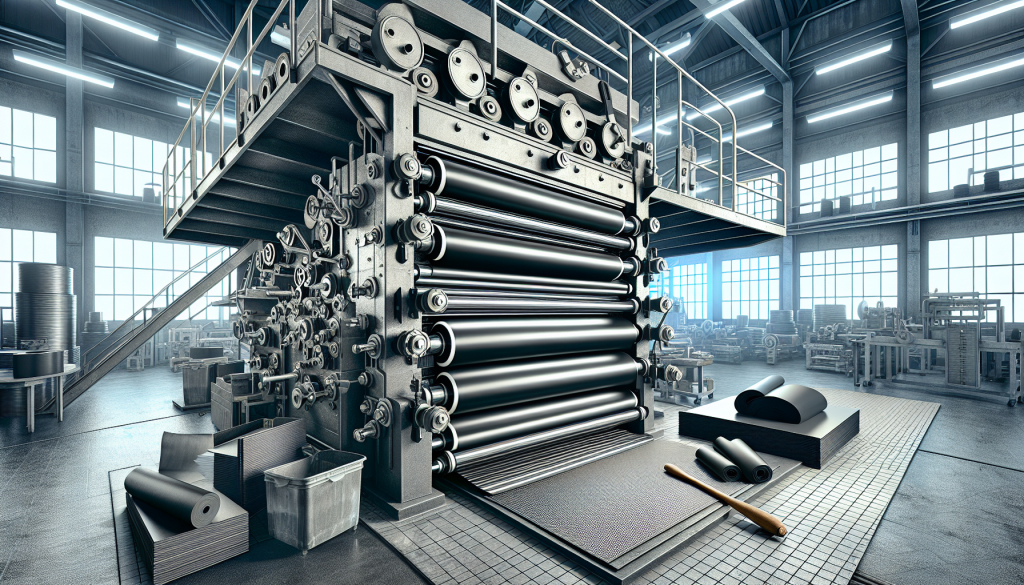

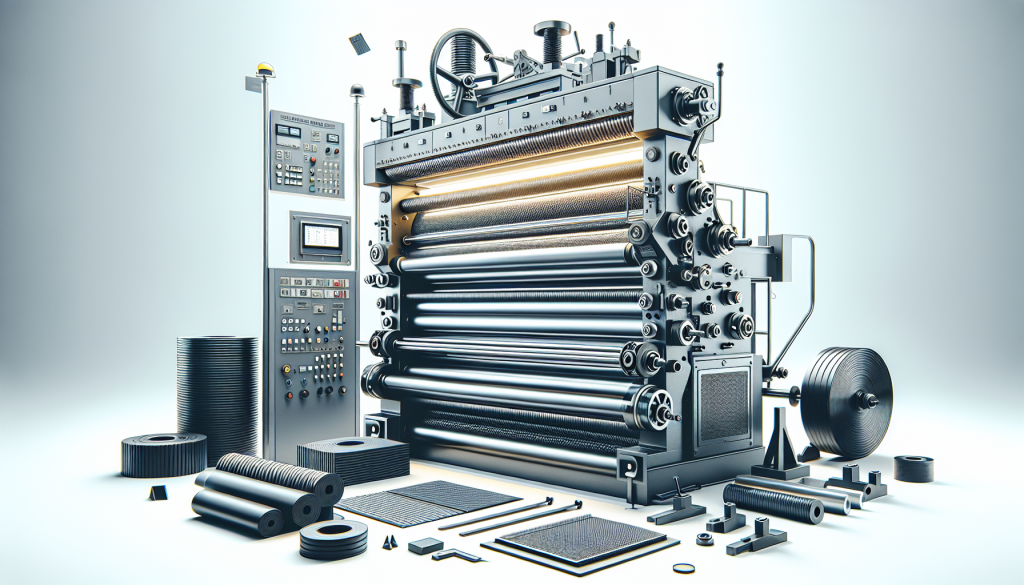

It’s essential to remember that failing to file correctly or omitting vital information can lead to severe penalties, delays in your shipments, and trouble with the authorities. In the case of rubber calenders—used primarily in the production of rubber products—ensuring compliance is vital for the success of your business.

Key Elements of ISF

In your journey to avoid ISF penalties for rubber calenders, understanding the key elements required for filing can make all the difference. The ISF requires the submission of:

- Supplier’s Name and Address: Identify your supplier to establish traceability.

- Manufacturer’s Name and Address: Ensure this is accurate to uphold compliance.

- Purchaser’s Name and Address: This leads back to you—the importer.

- Container Stuffing Location: Detail where the goods are packed.

- Consolidator’s Name and Address: Identify those involved in the transport process.

- Bill of Lading Number: A critical identifier for tracking purposes.

- Harmonized Tariff Schedule (HTS) Number: Essential for classification of goods.

- Country of Origin: Knowing where goods originate is key for regulatory purposes.

Once you have these elements in line, you help position yourself as a responsible importer and minimize the risk of penalties.

Common ISF Penalties for Rubber Calenders

Before you can effectively avoid ISF penalties for rubber calenders, it’s vital to know what those penalties might entail. They range in severity based on the nature and recurrence of the violation. Here’s a brief overview:

| Type of Violation | Penalty Amount |

|---|---|

| Failing to file ISF | Up to $5,000 |

| Incomplete or inaccurate filings | Up to $5,000 |

| Late filing | Up to $5,000 |

| Repeated violations | Per violation fee increases |

As you can see, these penalties can accumulate quickly, impacting not just your wallet but also your business reputation.

Strategies to Avoid ISF Penalties for Rubber Calenders

Now that you have a firm grasp on ISF and its associated penalties, let’s explore some practical strategies to ensure compliance.

Accurate Documentation

First and foremost, maintaining accurate documentation is essential to avoid ISF penalties for rubber calenders. Ensure that all forms are filled out correctly. Any missed or erroneous information could raise red flags and lead to financial penalties.

- Double-check all names and addresses for accuracy.

- Confirm the HTS code is appropriate for your goods.

- Ensure timely submission of ISF to avoid late filing penalties.

Work with Professional Importers

Utilizing a knowledgeable import partner can significantly alleviate the burden. Engaging professionals who specialize in Importer Security Filing can streamline the process and help mitigate risks.

- An importer security filing service can help guide you through the paperwork and ensure compliance with regulatory requirements.

- Entry filing services can verify that all details match and provide additional support to ensure accuracy.

- Establishing an import bond can also safeguard your operation by allowing you to comply while managing risk effectively.

Regular Training and Updates

Your team’s knowledge about ISF requirements is vital in avoiding penalties. Continuous education and training can empower your employees to remain vigilant and compliant.

- Conduct regular workshops and discussions on the latest updates in ISF requirements.

- Share resources that explain the technical aspects of logistics and import laws.

- Create a checklist that your team can reference to verify documentation accuracy before submissions.

Monitor Your Imports

After sending in your ISF, keep an eye on your imports. Awareness is key to managing your shipments effectively.

- Use tracking tools to monitor if your shipments arrive in a timely manner.

- Stay alert for any notices from CBP regarding your filings.

- If there’s a discrepancy, investigate immediately to resolve the issue.

Frequently Asked Questions about ISF Penalties for Rubber Calenders

Since knowledge is power, here are answers to some frequently asked questions that may arise as you navigate ISF requirements.

What happens if I miss the ISF deadline?

If you miss the deadline for filing your ISF, you may face penalties which can reach up to $10,000 for certain violations. This could significantly impact your operations, so always aim for timely submission.

Can I file my ISF late?

While it’s technically possible to file your ISF late, it’s not advisable. Late filings may lead to heightened scrutiny from CBP and greater risks of penalties.

How can I keep updated on ISF requirements?

Stay connected with industry associations and subscribe to news related to import logistics. Regular engagement with these communities will enhance your knowledge.

What should I do if I receive a penalty notice?

Upon receiving a penalty notice, it’s critical to respond swiftly. Consult with a compliance expert who can help you understand your options, including the possibility of appealing the penalty.

Call to Action for Professional Help

When it comes to import compliance, the details matter immensely. If you feel overwhelmed by the numerous regulations, consider seeking expert assistance.

- Importer Security Filing: A reliable service can ensure your filings are submitted promptly and accurately, reducing the risks of penalization.

- Entry Filing: Utilize expert entry filing services to help facilitate smooth clearance and compliance with all requirements.

- Import Bond: Ensure your operations are secure with a proper import bond, providing you peace of mind.

Taking these steps can mitigate the complexities involved with ISF and pave the way for your importing success.

Final Thoughts on Avoiding ISF Penalties for Rubber Calenders

Avoiding ISF penalties for rubber calenders is a journey filled with steps that demand careful attention. As an importer, adhering to regulations not only protects your financial interests but also enhances the credibility of your operation. Understanding the requirements, collaborating with experienced partners, and investing in ongoing education are pivotal strategies to ensure your compliance.

By integrating these practices into your importing process, you’re setting your business on a path to success.

Speak with an Import Expert for Free

As you navigate the intricacies of import compliance, don’t hesitate to reach out for expert guidance. Speaking with an import expert for free can provide tailored insights specific to your needs, ensuring that you stay compliant with ISF regulations. It’s not just about avoiding penalties; it’s about strategically building a successful importing operation. Let the experts guide you today!